Dedicated services

for your company

risk teams

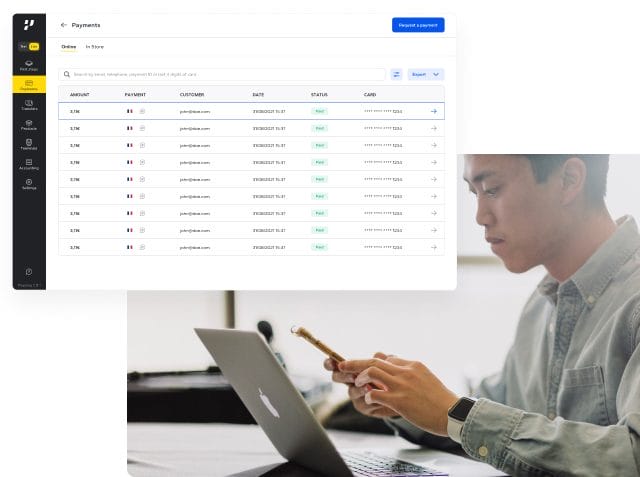

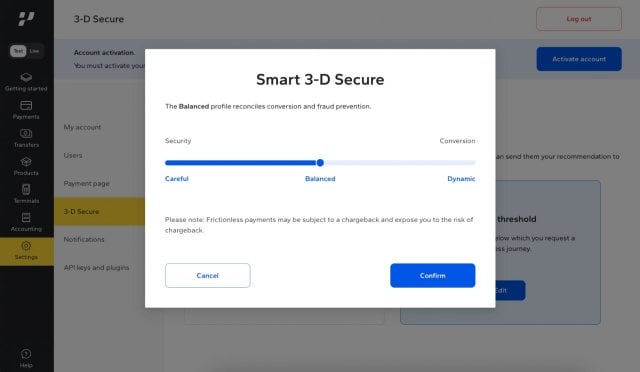

In-depth analysis of purchasing behaviour

Even when well controlled, fraud management remains a major concern because its evolution directly impacts your turnover. With our Fraud premium offer, you can minimise fraud and maximise your acceptance rate.